The Federal Open Market Committee (FOMC) of the Federal Reserve kept the federal funds rate steady at a range of 4.25% to 4.50% during their two-day meeting. The Federal Reserve extended its current federal funds rate because it maintains a reserved stance amid economic difficulties combined with ongoing inflation and international tensions.

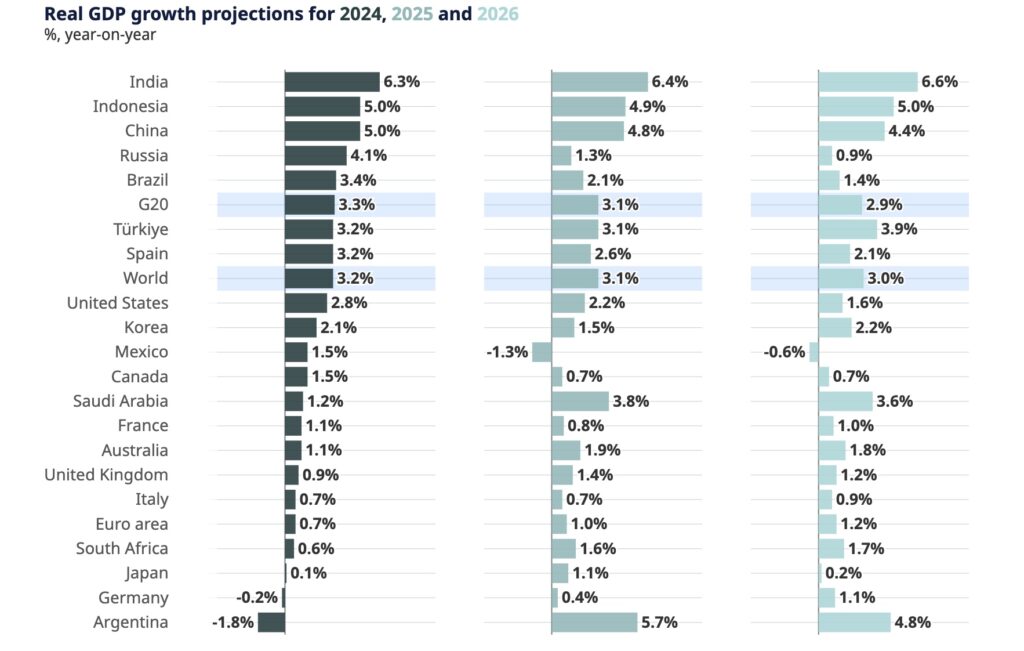

In recent months, economists have noticed that the United States’ economic growth has slowed down. According to the Organization for Economic Co-operation and Development (OECD), US GDP growth will slow to 2.2% in 2025 and even more to 1.6% in 2026, compared to what was expected before. Higher taxes and trade disputes cause key trading partners to spend less money, which slows down the economy.

OECD Secretary-General Mathias Cormann said, “The global economy has shown some real resilience, with growth remaining steady and inflation moving downwards. However, some signs of weakness have emerged, driven by heightened policy uncertainty.”

At the same time, inflation is still high. According to the Financial Times booth survey, the core personal consumption expenditures price index that the Federal Reserve records will be 2.8% by the end of 2025. The tariff policies have led to a rise in import prices, which in turn raises costs that impact what consumers can buy and how businesses operate.

The employment sector shows steady strength because unemployment numbers remain at 4.1%. Job market expansion together with wage growth enables families to maintain their purchasing capability which drives retail expenditure. Technical indicators suggest upcoming business challenges since manufacturer price rises combined with slumping customer expenditure point toward future market difficulties.

Investor Sentiment and Market Reactions

The confusing signals from different sectors have generated higher market fluctuations. The FOMC meeting caused U.S. stock prices to decrease because of technology mega-cap companies experiencing losses and intensifying international conflicts triggered by Israeli strikes on Gaza. The gold market rose to all-time highs because investors sought haven assets due to the uncertain relationship between global economic stability and tariff policies.

Federal Reserve’s Policy Stance and Outlook

Recent economic changes have led the Federal Reserve to choose its current interest rates approach through its data-based methodology. Fed Chair Jerome Powell stated that the Federal Reserve needs to continuously track economic data for determining proper monetary policy direction. The central bank operates to maintain both economic development alongside meeting its established inflation target of 2%.

Moving forward the Federal Reserve will need to manage conditions controlled by policy initiatives that create uncertainties. Prolonged trade disputes alongside elevated inflation levels handicap the Federal Reserve from implementing rate adjustments. The market will monitor the Fed’s communication activities to understand how it plans to adapt policy rates because of evolving economic conditions.

The Federal Reserve’s present policy maintains watchful stakeholders throughout various sectors while they seek understanding regarding how monetary policy will shift in response to evolving economic conditions during the following months.